Best Instant Personal Loan App | Get Loan in 2 Minutes

Emergencies do not provide information before this arrival Like Covid. In such cases, the best instant personal loan app is indeed a better solution, as this loan does not require collateral.

So to get a loan you do not have to worry about identifying your property or collecting documents for the valuation of the property you just need your mobile.

In this way, you can take full care of your emergency.

Best Instant loan app provides you a substantial amount of financial assistance, with its pre-approved loan offers.

After getting loan approval from the best instant personal loan app in this way, you can overcome the crisis without any hassle, because there is no restriction on how to spend the money.

With this, you can prevent high-interest debt from accelerating, meet business needs, or even pay your medical bills.

You can also use one or more parts of the loan for home renovation which you did not plan earlier.

Best Instant loan apps are found as an excellent way to give you a safer and hassle-free cash loan in India within an hour.

The list of the best instant personal loan apps in India-

| App | Monthly Interest Rate | Min & Max Loan Amount Rs | App rating (out of 5) |

| IndiaLends | 0.9% - 3% | Rs 15,000- 50lakh | 4.5 |

| KreditBee | 2.00-3.00% | Rs 1,000- 1 lakh | 4.5 |

| Capital First | 1.16% - 1.33% | Rs 1lakh – 25lakh | 4.4 |

| MoneyTap | 1.08%-2.03% | Rs 3,000-5lakh | 4.3 |

| Cash e | Starts from 1.75% | Rs 5,000 - 2lakh | 4.2 |

| LazyPay | 1.25%-2.6% | Rs 10,000-1lakh | 4.2 |

| Nira | 1.5%-2.5% | Rs 3,000- 1 lakh | 4.1 |

| PaySense | 1.08%-2.33% | Rs 5,000-5 lakh | 4 |

| Dhani | 1.00-3.17% | Rs-1,000 - 15 lakh | 3.9 |

| Upwards | 1.5%-2.6% | Rs-15,000 – 1lakh | 3.8 |

IndiaLends

IndiaLends is amongst the largest online personal loan provider in India. A sum-up of 40 banks has tied – up with IndiaLends to provide you with the loan. This app is easy to manage your expenses and is very efficient and gives you very fast approvals on loans.

This is an excellent app for an instant loan, Credit cards, and free Credit Score App with a 4.5-star rating.

KreditBee

The best Instant loan app designed especially for young professionals. You can get a loan up to Rs 1 lakh, and the process is highly online.

KreditBee provide The disbursement takes place in 15 minutes and the amount is directly transferred to your account.

This app has got a high rating of about 4.5 stars and has satisfied many people in need.

Capital First Limited /IDFC Bank

The first instant loan app Capital First or IDFC BANK loan app, which can sanction the application is not more than 2 minutes. The repayment is very efficient and can be paid in a flexible period of 1 to 5years.

After you become its existing customer it allows you to easily access account details, account statements, and even use service requests. This app is a full stop to all your financial needs.

MoneyTap

MoneyTap is based on no-usage-no-interest feature, which makes it different from other instant loan apps.

This feature makes you pay only for the amount you used. This app is working and servicing in 30+ cities in India.

The only disadvantage is MoneyTap does not have a customer service number. Please do not reach on fake numbers posted on google, youtube, Facebook, etc. You could get scammed.

Cash e

The only fintech company amongst the best instant loan apps.

Recently, Cash e has tied up with the bank markets. It takes not more than 8 minutes to transfer the amount to your bank by Cash e.

Cash e has eligibility of loan, anyone above 18 with a salary of 15,000 or more can easily take the loan. You can easily pay back the loan by bank transfer or check.

LazyPay

LazyPay app provides you with an instant personal loan up to 1 lakh. The best part is you will get advantages of this to pay later on the services of companies like Bookmyshow, Zomato, Swiggy, RedBus, and ACT Fibernet.

Users can also avail the EMI option for buying things like traveling and gadgets.

Nira

Nira provides you a line credit only to the salaried profession in India. The credit limit ranges from Rs 3,000 to Rs 1 lakh.

You have loan tenure from 3 months to 1 year and can withdraw Rs 5,000 each time.

In Nira the interest rate depends on how much amount you borrow and when you repay the amount.

Paysense

Paysense provides you with loans for emergency medicines to gadget purchasing.

It only provides services to the applicants which are employees and get a salary of Rs 15,000 per month in the bank.

The age limit criteria range from 21 years to 60 years. In other conditions, you can get the amount in about 3-4 working days.

Dhani app

Dhani app provides you loan from an adhaar card or PAN card. The loan installment is ranged from 3 months to 24 months.

It instantly deburses the loan amount to your bank account. You can apply for a personal loan anywhere and anytime, to add a full stop to financial issues.

You can range your borrowed amount from Rs 1,000 to 1.5 lakh rupees by just verifying your adhaar card.

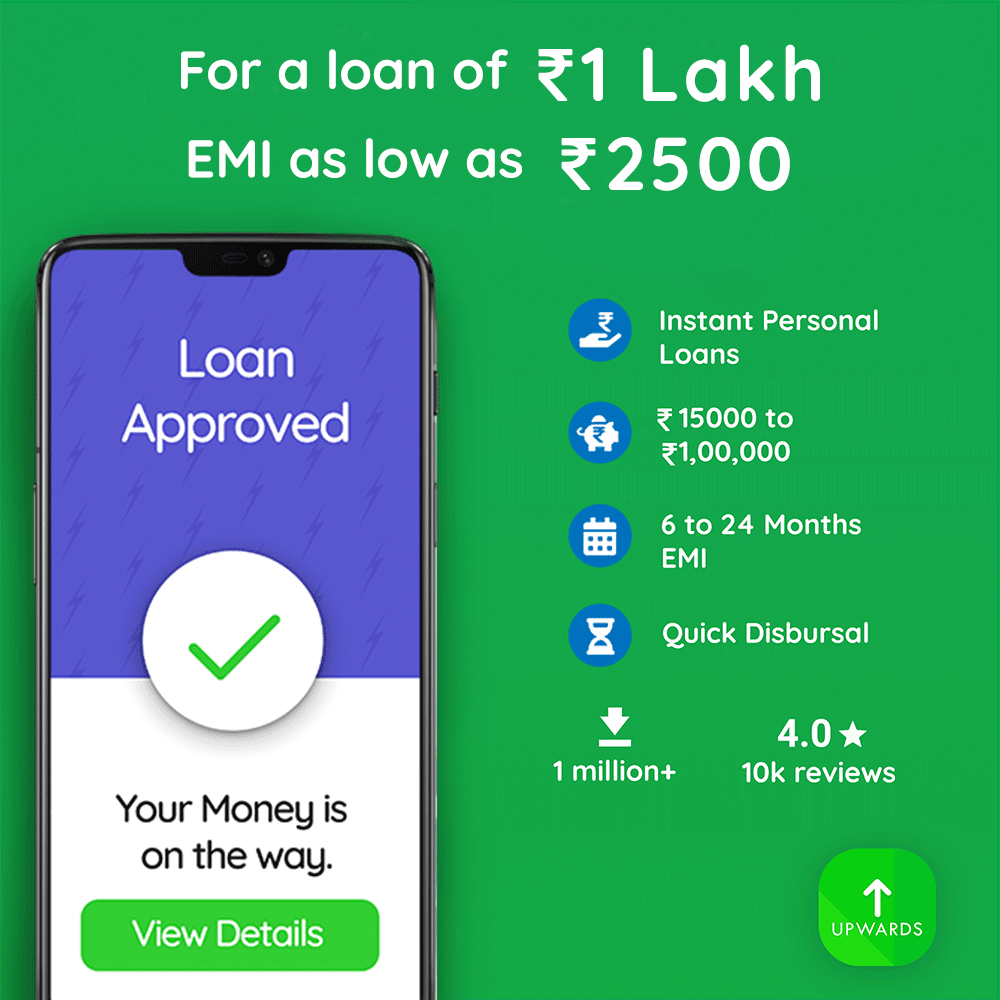

Upwards

Upwards This is claimed as the quickest of all personal loan provider apps. This app offers hassle-free loans to many employees, teachers, accountants, nurses, and many more with a salary of more than Rs 15,000.

This is the best app for individuals who are looking for short term loans between Rs 15,000 to Rs 1 lakh.

For a short period, there is less risk on loan taken because it involves a small amount and is for a short period.

For a long time, you have to pay money for a long time in a loan taken, you have to pay money for a long time in a loan taken, which increases the risk of default.

You can choose short term loans without worrying or compromising on long term goals.

Instant loans should be used as the last option to get out of the financial crisis and when there is no other option left to arrange money.

Once you take this loan, it should be handled with care and repaid at the earliest.

The post Best Instant Personal Loan App | Get Loan in 2 Minutes appeared first on Earticleblog.

* This article was originally published here

No comments: